Alan Letton and Linda Sharkus, Innovative Technology Management LLC

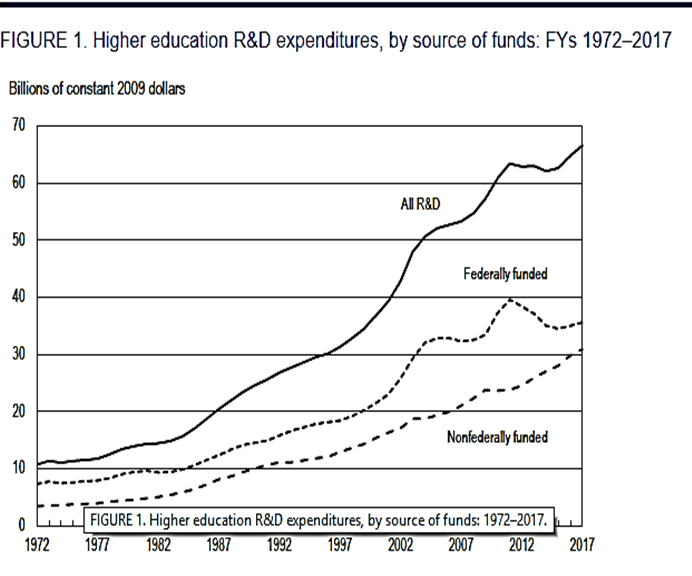

University based research and development has been on a steady rise since the early 80’s as shown in Figure 1; partly because of the passing of the Bayh-Doyle Act in 1989, which granted the universities the right to develop or license the intellectual property (IP) developed under Federal grants. With this approval came an increase in grant applications and funding that in turn led to significant effort in patent development.

To facilitate this

activity, the number of tech transfer offices also increased, seeking to make a

profit from such IP growth. But at the

end of the day, there was limited revenue generated from licensing or sale of

the IP. The schools producing the most

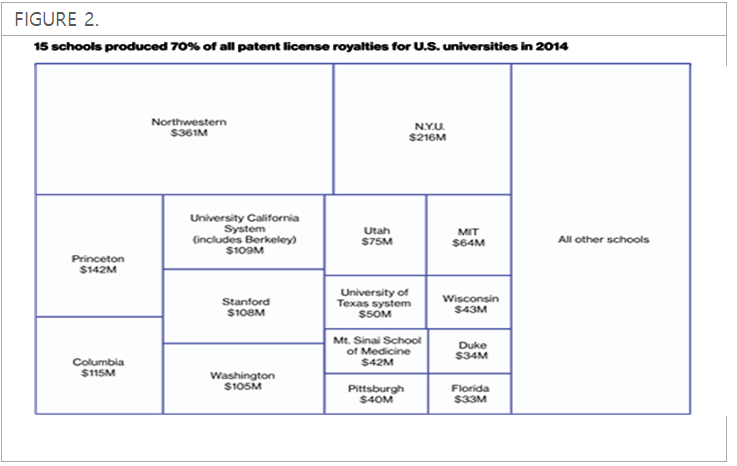

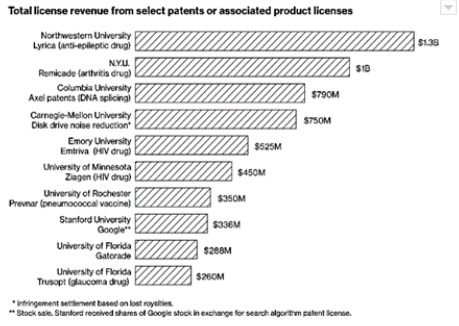

royalties in 2015 are shown in Figure 2. Most of the developed revenue was

predominantly in the drug discovery space as shown in Figure 3. Why so little revenue one might ask? Why so little development in the physical

sciences?[i]

There are approximately 6000+ new university patents generated each year, and approximately 320,000 more from non-university inventors. The breakdown of all US patents is heavily dominated by electrical engineering (including semiconductors and computer hardware) and chemical-related technologies (55%), followed by electronic instrumentation, mechanical engineering and then pharmaceutical and biotechnology.

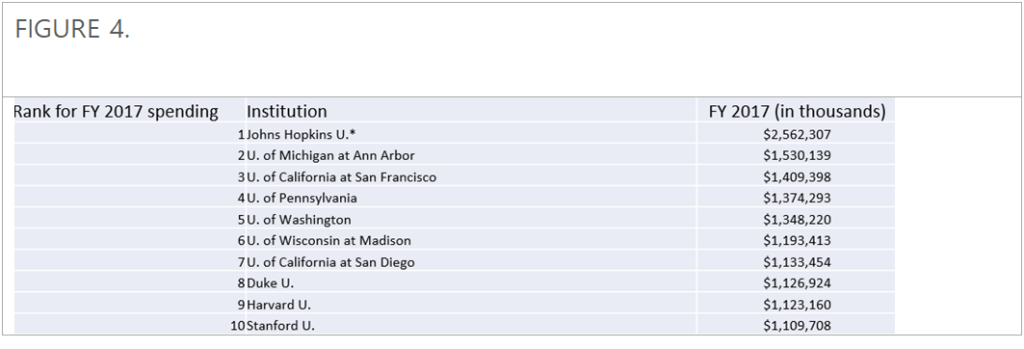

For many consecutive years, however, the combined areas of Pharmaceuticals, Biotechnology, IT and Fin-tech have dominated the majority of university patents (60%) in opposition to patents in the areas of physical sciences, engineering and process manufacturing technologies (40%). Thus, there is a discrepancy between realized revenues from university technologies, and patents generated by universities and the nation as a whole. The Rank for 2017 Research Spending is shown in Figure 4.

So, if you wanted to leverage university IP as an investor or entrepreneur, how would you identify the most marketable university patents assuring alignment with the market opportunity? Imagine having to manually screen patents and relate them to markets, trends and investment potential!

Innovative Technology Management LLC (ITMC), in conjunction with ipCapital Group, is creating an AI based system that will score the quality, potential risk and fit to market of a technology, yielding a prioritized ranking that is designed to create a unique portfolio of technology investment opportunities. You can learn more about this approach by contacting us, Innovative Technology Management LLC. The ipDimensional Scoring System[1] already in use scores patents based upon many quality metrics that have been used for over 15 years, to find high quality patents for license, sale or litigation. The new AI based system will (1) automate the initial ipDimensional Scoring system to run daily and inform the user when there are significant changes to any of the university patents, (2) automate Evidence of Use, (3) automate IP valuation, (4) use machine learning to predict the value of each university patent and (5) provide in depth reports, as needed to help with investment, due diligence, etc.

Innovative Technology Management, LLC is the Investment Manager for Innovative Technology Prototyping Fund, LP, with the investment objective of achieving a risk-adjusted, superior rate of return, by utilizing artificial intelligence (AI) to identify patents and licensing those assets in advanced engineering and applied science technologies that are created in U.S. universities and federally owned and funded research laboratories. The fund is committed to developing these assets by helping design and construct working prototypes for new products by leveraging the expertise of the Management Team, Dr. Alan Letton and Dr. Linda Sharkus, in conjunction with several advisors.

ipCapital

Group, an Innovation and IP consulting practice for 21 years, is partnering

with Innovative Technology Management LLC to help find the best university IP,

and then once financed by Innovative Technology Management LLC, will help to

develop and execute a strategic world-class IP portfolio.

[1] https://www.bloomberg.com/graphics/2016-university-patents/

[1] https://www.chronicle.com/article/Universities-With-the-Highest/245414

Disclosures

This document is provided for informational purposes only and does not constitute an offer to sell or the solicitation of an offer to purchase any securities, including those of any fund or account (each, a “Fund”) managed by Innovative Technology Management LLC (“ITMC”). Any such offer or solicitation may be made only by means of the delivery of a confidential offering memorandum, which will contain material information not included herein, including with respect to conflicts of interest and risks, and shall supersede, amend and supplement this document in its entirety. This information contained in this document is current only as of the date specified, irrespective of the time of delivery or of any investment, and does not purport to present a complete picture of ITMC or any Fund. The information presented herein may not have been audited or realized, and should not be relied upon as such. No assurance can be given that investment objectives will be achieved, and, subject to the terms of the offering and governance documents of any given Fund, ITMC is not limited with respect to the types of investment strategies it may employ or the markets or instruments in which it may invest. The information included in this document has been obtained from sources ITMC believes to be reliable; however, these sources cannot be guaranteed as to their accuracy or completeness. This document contains certain “forward-looking statements,” which are subject to various factors, any or all of which could cause actual results to differ materially from projected results.